Table Of Content

With property taxes being so variable and location-dependent, you’ll want to take them into account when you’re deciding on where to live. Many areas with high property taxes have great amenities, such as good schools and public programs, but you’ll need to have room in your budget for the taxes if you want to live there. For the past five years, Republican lawmakers have been on a crusade to rein in the state's property taxes, among the highest in the nation. The Tax Office accepts property tax payments online, by telephone, by mail or in person. Persons paying property taxes may use multiple and any combination of credit cards or multiple e-checks to pay their taxes. Partial payments are accepted and will reduce any penalty and interest owed.

Overview of California Taxes

For example, a rural city in Oklahoma likely has a way lower real estate tax rate than a popular big city on say, one of the coasts or in a major metropolis like Dallas or Chicago. You may live in an area that levies significant property taxes or caps exemptions at a low threshold. If you are struggling to afford your current tax liability, consider refinancing your property, as it can help lower the costs tied to owning a home. If you are considering a real estate search, you’ll want to think about the location’s property taxes since they add to your homeownership costs. With that in mind, here is a basic rundown on the financial charge and a list of property taxes by state to help you start. People often use the terms property tax and real estate tax interchangeably.

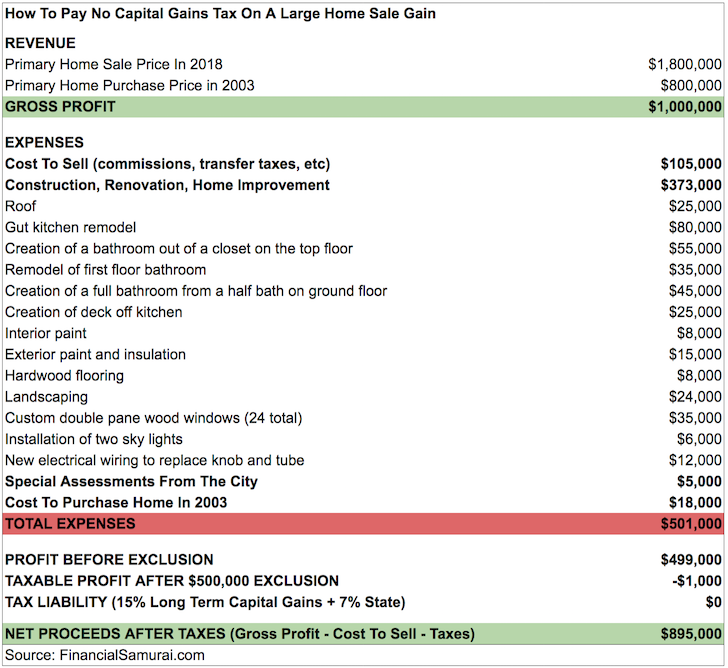

Tax Deductions to Take When Selling a Home

You can carry forward this amount to the next 3 years or until used, whichever comes first. The MCC will show the certificate credit rate you will use to figure your credit. Only the interest on that amount qualifies for the credit.

Are property taxes included in mortgage payments?

After determining the home's market value, the assessor applies an assessment rate to find out the amount of your home's value that can be taxed. This is a percentage that varies by tax jurisdiction; it could be anything below 100%. The assessor then applies your local mill levy to determine the amount of property tax due.

Metropolitan Water District soaks taxpayers…

Sarah Sharkey is a personal finance writer who enjoys diving into the details to help readers make savvy financial decisions. She’s covered mortgages, money management, insurance, budgeting, and more. When she's not writing, she's outside exploring the coast.

This can be especially helpful if you’re on a fixed income. In addition to knowing your home’s assessed value, you will need to know another number, known as a mill levy. That’s the tax assessment rate for real estate in your area. The tax rate varies greatly based on the public amenities offered and revenue required by local government. Property taxes can be a financial burden for some, but deductions, credits and exemptions can potentially lower property taxes.

Joshua Fechter, The Texas Tribune

Somehow, in the opinion of the MWD, voters in 1960 approved whatever it is and whatever it costs. The new budget raises the wholesale rates by 8.5% in 2025 and then by 8.5% again in 2026. The homestead exemption had its biggest increase last year after voters approved boosting the exemption to $100,000. Those growing bills resulted in growing pressure on lawmakers to do something to rein in taxes. The owners of a home in a quickly gentrifying Dallas neighborhood.

You have a place to call home that you can decorate, remodel, and renovate as you choose. You can also deduct certain expenses like mortgage interest and property taxes, which helps lower your tax bill for the year. But if you qualified for any exemptions, you might be able to tap into a lower property tax bill.

Vt. House approves ‘yield bill,’ setting property tax hike in motion - WCAX

Vt. House approves ‘yield bill,’ setting property tax hike in motion.

Posted: Wed, 24 Apr 2024 20:15:00 GMT [source]

LOS ANGELES COUNTY HOLIDAYS

The statement must show the calculation for lines 1, 2, and 3 for the part of the year when the old MCC was in effect. It must show a separate calculation for the part of the year when the new MCC was in effect. Combine the amounts from both calculations for line 3, enter the total on line 3 of the form, and enter “See attached” on the dotted line next to line 2. After applying the limit based on the credit rate, your credit generally can't be more than your tax liability. See the Credit Limit Worksheet in the Form 8396 instructions to figure the limit based on tax. If your mortgage loan amount is equal to (or smaller than) the certified indebtedness amount shown on your MCC, enter on Form 8396, line 1, all the interest you paid on your mortgage during the year.

You must add the cost of any improvements to the basis of your home. The facts are the same as in Example 1, except this time Andrew sells the house for $70,000. He will have a loss of $10,000 because he must use the FMV ($80,000) at the time of the gift as his basis to figure the loss. The cost of your home, whether you purchased it or constructed it, is the amount you paid for it, including any debt you assumed. If your home is transferred to you from your spouse, or from your former spouse as a result of a divorce, your basis is the same as your spouse's (or former spouse's) adjusted basis just before the transfer. 504, Divorced or Separated Individuals, fully discusses transfers between spouses.

If you didn't receive a Form 1098, enter your deductible interest on line 8b, and any deductible points on line 8c. See Table 1 for a summary of where to deduct home mortgage interest and state and local real estate taxes. In addition, you can treat as home mortgage interest your share of the corporation's deductible mortgage interest. Figure your share of mortgage interest the same way that is shown for figuring your share of real estate taxes in the Example under Division of real estate taxes, earlier. For more information on cooperatives, see Special Rule for Tenant-Stockholders in Cooperative Housing Corporations in Pub.

So, you might find yourself paying a little more when taxes are due, but that also means you could receive a property tax refund if you overpay. To calculate your property taxes, an assessor will perform a tax assessment to determine what your property is worth. That number can differ from the appraised value of your home, which represents a property’s market value (resale value) rather than its taxable value. Thankfully, in many cases, you may not have to calculate your own property taxes. There are a number of factors that come into play when calculating property taxes, from your property’s assessed value to the mill levy (tax rate) in your area.

To get an idea of where your property tax money might go, take a look at the breakdown of property taxes in Avondale, Arizona. It was a remarkable achievement in the face of enormous odds. By the turn of the 20th century, though, a clear pattern of over-taxation of Black-owned property was apparent across the South. More deviously, local tax authorities were quick to auction off Black-owned land for unpaid taxes, especially when the land in question had become valuable. Metropolitan said it has to raise rates and taxes to cover its operating costs because they’ve been selling less water, first because of drought, and then because of rain.

No comments:

Post a Comment