Table Of Content

You can deduct the full amount of points in the year paid if you meet all the following tests. Payments made to end the lease and buy the lessor's entire interest in the land aren't redeemable ground rents. You may be able to take a credit if you made energy saving improvements to your home located in the United States in 2023. Certain tax benefits, including the following, that were set to expire have been extended.

How often do you pay property taxes?

The seller must give you this number and you must give the seller your SSN. Form W-9, Request for Taxpayer Identification Number and Certification, can be used for this purpose. Failure to meet either of these requirements may result in a $50 penalty for each failure.

OFFICIAL STATEMENTS

To understand how property taxes work, you should know how they're calculated. Your county assessor evaluates each property based on its type and any improvements, and assigns a property value. Typically, properties are assessed every one to five years to capture any change in value and to ensure the property tax reflects that change. Your property taxes support local government operations and critical infrastructure like roads, water, sewer systems, and schools. Property taxes are the costs charged by local jurisdictions (state, county, municipal, township, school district, or special district) for your house and plot of land within the jurisdiction. As a renter, you probably didn't give them a second thought.

Business Activities That Require a County Business License

However, the exact process used by your local government will be determined by your state and county. You can also add them to your monthly mortgage payments after you’ve bought a home. It’s easier for some people to pay their property taxes this way because it means they don’t owe a big lump sum once a year.

How Property Tax is Determined

Please check with the Harris Central Appraisal District (HCAD) for further information. You owned the home in 2023 for 243 days (May 3 to December 31), so you can take a tax deduction on your 2024 return of $946 [(243 ÷ 365) × $1,425] paid in 2024 for 2023. You add the remaining $479 ($1,425 − $946) of taxes paid in 2024 to the cost (basis) of your home. You can't deduct any of the taxes paid in 2023 because they relate to the 2022 property tax year and you didn't own the home until 2023.

Sacramento County

From there, the assessed value increases every year according to the rate of inflation, which is the change in the California Consumer Price Index. When you buy a home, you'll need to factor in property taxes as an ongoing cost. It’s an expense that doesn’t go away over time and generally increases as your home appreciates in value. In fact, Metropolitan will charge property owners forever, because the law has been interpreted to allow these extra charges on property tax bills to cover the cost of maintaining and operating the State Water Project. The rate hikes are bad enough, but I’ll bet you’re wondering how it can be legal for the Metropolitan Water District to raise property taxes. Other signs abound that property tax bills for homeowners across the state have fallen from their pandemic highs.

Cities, counties could impose local sales taxes to fund certain infrastructure projects - Session Daily - Minnesota House of Representatives

Cities, counties could impose local sales taxes to fund certain infrastructure projects - Session Daily.

Posted: Fri, 12 Apr 2024 07:00:00 GMT [source]

This means that if your home was assessed at $150,000, and you qualified for an exemption of 50%, your taxable home value would become $75,000. The millage rates would apply to that reduced number, rather than the full assessed value. These credits are subtracted from any taxes you might owe. Once you find that number, you have your total property tax bill. This is the ratio of the home value as determined by an official appraisal (usually completed by a county assessor) and the value as determined by the market. In many cases, governments seize homes from aging seniors in cognitive decline, or individuals with mental disabilities, often based on relatively small amounts of tax debt, leaving the homeowner destitute.

Approved Independent Delivery Services

If an estate tax return wasn't filed, your basis is the appraised value of the home at the decedent's date of death for state inheritance or transmission taxes. Andrew received a house as a gift from Ishmael (the donor). After he received the house, no events occurred to increase or decrease the basis.

OTHER PAYMENT METHODS

So in this situation, Andrew will have neither a gain nor a loss. If you bought your home after 1990 but before April 4, 1994, you must reduce your basis by seller-paid points only if you deducted them. If you refinance your original mortgage loan on which you had been given an MCC, you must get a new MCC to be able to claim the credit on the new loan. The amount of credit you can claim on the new loan may change. Table 2 summarizes how to figure your credit if you refinance your original mortgage loan.

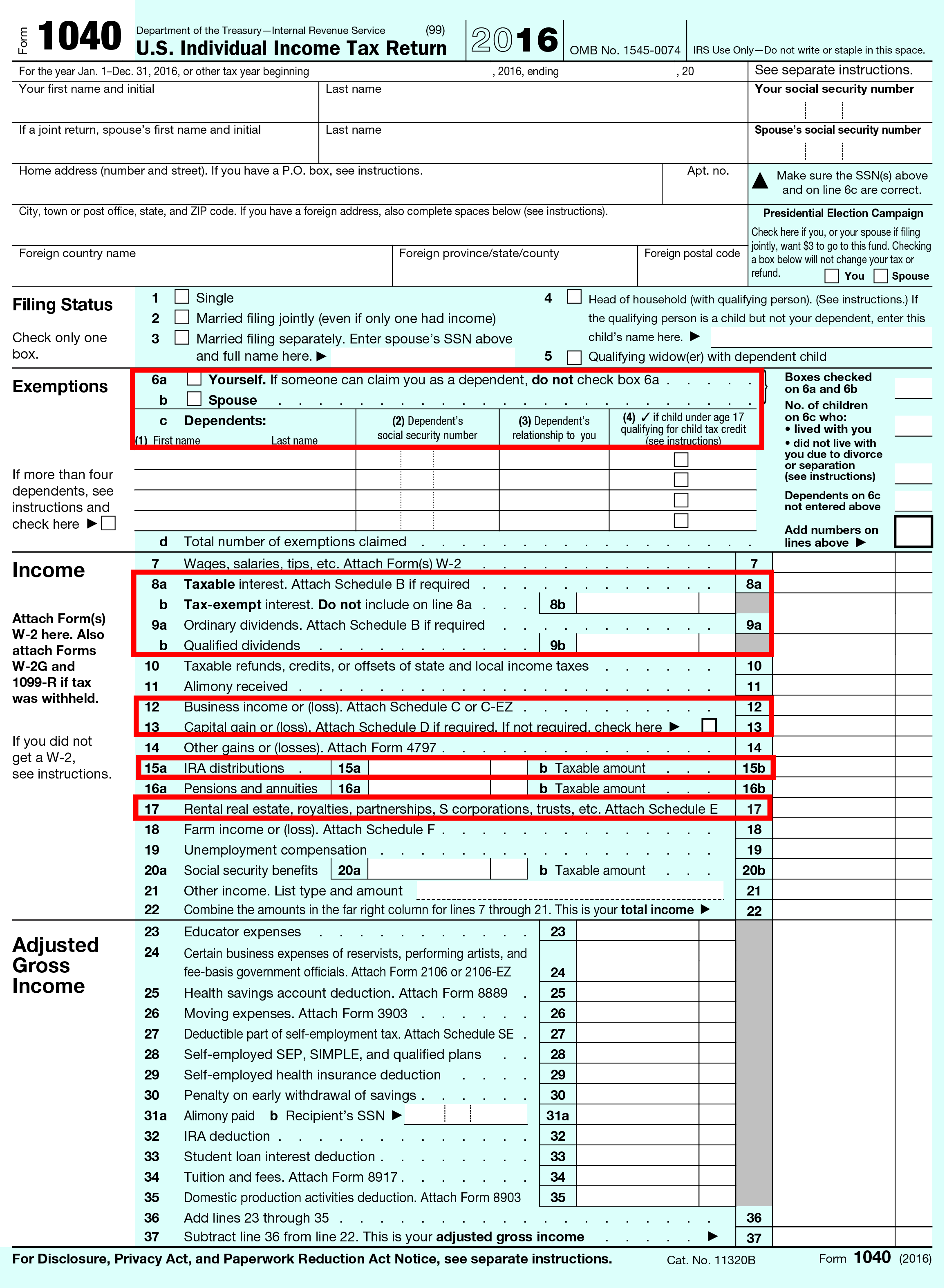

You can only deduct home mortgage interest to the extent that the loan proceeds from your home mortgage are used to buy, build, or substantially improve the home securing the loan. The only exception to this limit is for loans taken out on or before October 13, 1987; the loan proceeds for these loans are treated as having been used to buy, build, or substantially improve the home. To deduct expenses of owning a home, you must file Form 1040, U.S. Income Tax Return for Seniors, and itemize your deductions on Schedule A (Form 1040).

The IRS remembers the depreciation deductions you took -- and they'll want some of that money back. It's based on your ordinary income tax rate and capped at 25%. It applies to the part of the gain that can be attributed to the depreciation deductions you've already taken.

You can deduct your $426 share of real estate taxes on your return for the year you purchased your home. Generally, you can elect to deduct state and local general sales taxes instead of state and local income taxes as an itemized deduction on Schedule A (Form 1040). You must check the box on Schedule A (Form 1040), line 5a, if you elect this option. Deductible sales taxes may include sales taxes paid on your home (including mobile and prefabricated), or home building materials if the tax rate was the same as the general sales tax rate. For information on figuring your deduction, see the Instructions for Schedule A (Form 1040).

Yes, homeowners can challenge their property taxes, at least to a point. The first step is to understand the basis for your tax assessment and review it for any errors. You can then ask the assessor to make the correction or conduct a re-evaluation. If you find an error, your jurisdiction is required to correct it.

DefaultedThe unpaid property taxes at the end of the fiscal tax year. For example, the Office of the Assessor calculates property taxes based on the assessed value of a property. You can't depreciate a property that you put in service and sell (or remove from service) during the same year. And because land doesn't wear out, get used up, or become obsolete, you can't depreciate it.

That rate is a uniform percentage and varies by tax jurisdiction. The assessed value is multiplied by the mill levy to determine your property taxes due. Service FeesA charge for processing all credit/debit card transactions for property tax payments.

Check with the appropriate local services if you need help navigating the available programs. States do their property assessments at different frequencies, some annually and others every couple of years. The assessor can estimate the market value of the property by using three methods and they have the option of choosing a single one or any combination of the three. The amount that a property is taxed comes from a percentage of the assessed value of the property.

No comments:

Post a Comment